How To Repair A Bad Covered Call

Fixing a Good Trade Gone Bad: Four Ways To Save a Losing Merchandise

You accept a losing merchandise just don't want to sell. Larn near rolling a losing call option and other strategies to save a losing trade.

March xviii, 2022

Photo by TD Ameritrade

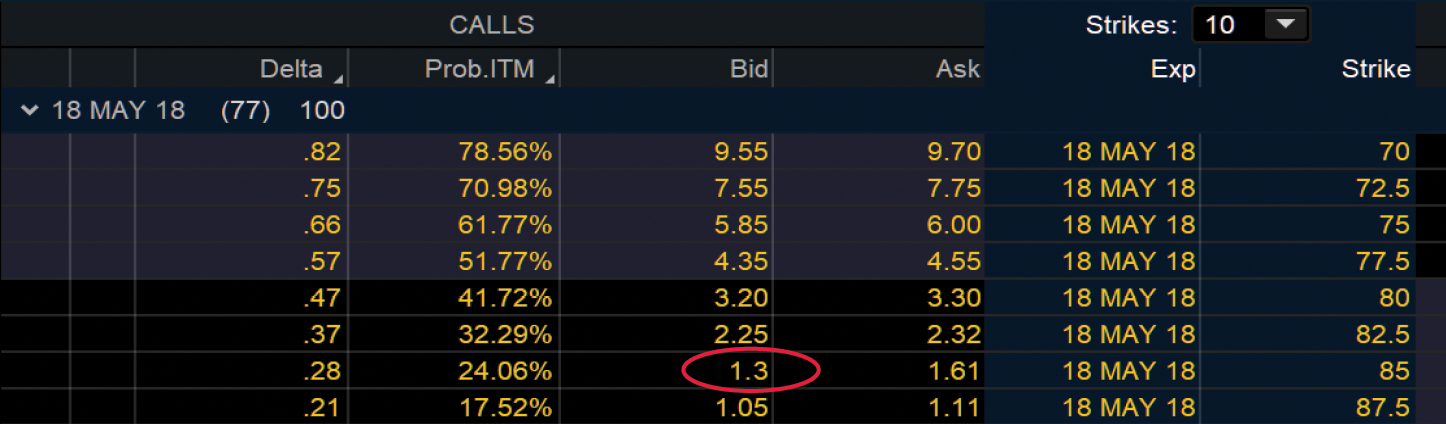

And then y'all have a loser, only don't want to close it out. Mayhap it's a complex merchandise like an atomic number 26 condor. Or maybe it'due south a single long selection. Or maybe it'due south only stock. What tin you lot do? Kickoff, don't panic. Cooler heads prevail. Second, if y'all're going to "fix" your trade, don't wait until in that location's nothing left to fix. When is losing too much, well, also much? Many traders follow a quick rule: Cut your losses if the trade loses one-half or more of its original risk. But that may non be a adept fit for all strategies. Before fixing a trade, you lot need to sympathize that you're non really "fixing" anything. The loss is real, and any sort of ready is actually a new trade. Then, the better question becomes, "Does my original analysis nonetheless hold, and would it be better to adjust my position or exit the trade and move on?" Consider iv common scenarios and potential ways to fix 'em. The situation: If you bought stock at the wrong time, it might exist the right time to innovate yourself to the short telephone call option. By selling a phone call option, you're giving someone else the right to purchase the stock at a fixed cost, meaning the strike toll. And that means you're obligated to sell the stock if the buyer decides to exercise their right. So, cull your strike price advisedly. In exchange for this obligation, you'll collect the premium from the trade, minus transaction costs, and that reduces your break-even point. Permit's suppose you bought 100 shares of stock at $85, and it promptly moved lower to $80. The prepare: Using the options prices from figure 1, y'all could, for example, sell the 85 strike telephone call for $1.thirty. Subtracting $1.30 of premium from your stock purchase price of $85 leaves y'all with a interruption-even price of $83.70. And, once you've sold the telephone call confronting your long stock, you now hold a "covered call", which is a strategy some traders use from the start every bit a means of generating income when buying stock. FIGURE 1: SELLING A Curt Call Option. Source: The thinkorswim® Platform. For illustrative purposes only. If the stock remains below $85 through expiration, then your selection will expire worthless, and you can get your merry manner. Or, you tin can cull to sell some other call to move your pause-even cost fifty-fifty lower. All the same, if the stock moves higher than $85 prior to or at expiration, two things could happen. One: zilch. Depending on the days left until expiration, and how high the stock goes, yous might be able to buy back the option to close information technology at a lower toll than you sold it. That would be a win-win. Or, you might decide to ride the position out until expiration and see where the fries autumn. Two: you might become "assigned"—trader-speak that, in this case, means yous have to sell your stock. Don't sweat it. You lot merely sell the stock at $85, which is the price you bought it for anyway. And you get to keep the $i.35 premium you took in equally profit (minus commissions and fees). The result: You don't increase your risk by selling the call option. You're just lowering a break-even bespeak and giving upwards potential profit to a higher place your strike at the same time. But you may notice it worthwhile to buy the phone call to shut information technology out if it's in the money prior to expiration, and you don't want to lose your shares. The situation: Long calls and long puts tin be successful when the underlying stock is moving in the right management. But what if the stock takes a break or fifty-fifty starts to movement against y'all? Or, what if these or some other factors crusade the unsaid volatility of the choice to drop? The ready: One way to salvage this merchandise could exist selling some other option that's further out of the money (OTM) than the option you ain simply in the same expiration. This turns your long pick into a long vertical spread (encounter figure 2). The premium from the sale of the further OTM option lowers the trade's overall debit past the premium you collected, only information technology will also limit the potential profit on the position. The result: A few good things can happen. First, your total dollar take a chance is reduced. Second, your trade should now exist able to withstand a greater reversal in the stock's toll or a driblet in implied volatility. Finally, your merchandise might still profit if the stock one time once again moves in the desired direction. Figure 2. LONG CALL VERTICAL VS. LONG CALL. The situation: If it's a short put position that's moving against you, then either the stock is moving lower, the implied volatility is ticking higher, or perchance some of both. It might be a good time to sell an at-the-money (ATM) or OTM call vertical to kickoff some of the brusk put'south loss. The short put is a bullish merchandise. But selling a call spread is a bearish trade. The prepare: If you think selling the call spread is a good idea because yous believe the stock is going to keep moving lower, you lot might want to close your original merchandise. Only if you think the move lower is brusque term, then selling a short-term call vertical may be a expert ready. The premium you collect from the call spread is added to the premium you collected from the put. At expiration, if the stock is above your short put, but beneath the strike of the short call, and then all the options would be expected to elapse worthless and yous'd keep the net premium. The outcome: Selling the call spread doesn't increase your overall dollar gamble, but it could hurt yous if the stock reverses course and moves higher like you lot originally thought. Remember, "fixing" a merchandise is essentially putting on a new trade. Understand the new trade's structure and plan for a new outcome. The situation: What if you lot sold an OTM telephone call or put vertical and at present it'due south turning into more of an ATM spread? In that location's normally more than than one way of "fixing" trades that get against you, and so here are two possible approaches for short verticals that are getting too close to the money. The fix: Offset, consider turning your position into an iron condor. If it'south a call vertical that's hurting y'all, yous would sell an OTM put vertical. If a put vertical is to blame, you'd sell an OTM call vertical. The new position—the iron condor—wants the stock to settle in between the short strikes of both vertical spreads. The result: Again, the premium yous collect adds to your overall position credit. Although y'all haven't increased your overall dollar risk, you at present have more places where the stock can hurt you. You've also added boosted transaction costs. Figure 3: Scroll WITH Information technology. Y'all could open a phone call spread that has more days to expiration. For illustrative purposes only. The second fix: You lot could consider rolling into a new vertical spread. If the stock is threatening to tendency correct through your curt vertical, turning the trade into an fe condor might non alleviate losses from the side that'south getting likewise close to the money. Instead, maybe pack upward your merchandise and "coil" it to a new neighborhood. For example, using an underlying stock price of $80, suppose you sold an 82-84 near-month telephone call spread for $0.30 with a few weeks to expiration. Some time passes, but the stock has moved higher to $82, with a week until expiration. You lot could consider "rolling" the spread past ownership it to close for a debit of $0.twoscore, and then selling to open the 84-86 call spread farther out in fourth dimension for $0.80. Using the prices in the tabular array in figure iii, the roll plus the new vertical can be completed for a credit of $0.l, not including transaction costs. The second event: Now your short strike is $2 further away from the coin, giving you lot some animate room. The trade, nevertheless, now has more time before information technology expires. And then you'll need to monitor things in case yous need to make another determination to roll once again or exit. Finally, think that commissions can really add together up. Every "fix" has pros and cons. Only you can cut your losses past selling options premium elsewhere without necessarily cutting the trade. If you do, y'all can potentially amortize your loss, and hang effectually a footling longer to see what happens side by side. This is what many pro traders do automatically—expect a losing position in the centre and know what to practice.Long Stock

Long Call or Long Put

Short Put

Short Vertical

Source: https://tickertape.tdameritrade.com/trading/how-to-fix-losing-trades-15001

Posted by: bartongrece1966.blogspot.com

0 Response to "How To Repair A Bad Covered Call"

Post a Comment